Hurricane Sandy has shut down the New York Stock Exchange. The last time a natural catastrophe forced Wall Street to go into hibernation was Hurricane Gloria in 1985.

Even though trading at the NYSE?has halted, investors never stop looking for the next opportunity. What sectors will be most affected by this or any other hurricane and are there any profit opportunities?

Insurance Sector

It?s yet to be seen what kind of damage Sandy will cause. According to the National Oceanic and Atmospheric Administration (noaa.gov), Katrina was the most expensive hurricane with damages of $145 billion.

Someone has to pay for that damage and insurance companies (that?s what we have insurance for) will end up paying a fair share of the repairs.

Property and Casualty Insurance companies collected about $471 billion worth of premium in 2010. According to a report by the Congressional Research Service, done right after hurricane Katrina devastated New Orleans.?The net profit earned on the $471 billion worth of premium should be about $40 billion.

The same report states that: ?Most insurance experts would agree that the $100 billion-plus catastrophic event remains a challenge for the U.S. property and casualty insurance industry.?

A common sense approach to investing suggests to stay away from the insurance sector and ETFs like the SPDR S&P Insurance ETF. Of course, the ultimate cost of any disaster will be passed on to policyholders via increased insurance premiums.

Energy Sector

The New Jersey coast is home to more than six large refineries and has a refining capacity of 1.2 million barrels per day. As of Monday, two thirds of the refineries were shut down.

New Jersey refineries account for about 7% of total refining capacity in the U.S.?In comparison, the gulf coast accounts for 45% of U.S. refining capacity.

The decreased energy demand of the densely populated East Coast caused by hurricane Sandy could be about the same or more than?the loss of refining capacity. This means rising oil and gasoline prices nationwide are far from guaranteed.

In fact, immediately following hurricane Katrina, oil prices dropped a stunning 21%. Hurricanes are not an automatic buy signal for ETFs like the Energy Select Sector SPDR (XLE), S&P Oil & Gas Exploration & Production SPDR (XOP) and others.

Home Construction Sector

Home improvement stores like Home Depot and Lowe?s should attract a big chunk of the disaster prevention and disaster repair dollars spent. The iShares Dow Jones US Home Construction ETF (ITB) has an 8.7% exposure to Home Depot and Lowe?s.

Retail Sector

Will money spent at Home Depot and Lowe?s cannibalize the holiday spending budget? Retailers like Macy?s, Kohls, Gap, Nordstrom, Tiffany, Amazon, Best Buy ? all part of the S&P Retail SPDR ETF (XRT) ? could suffer from Sandy.

Hurricanes and the Stock Market

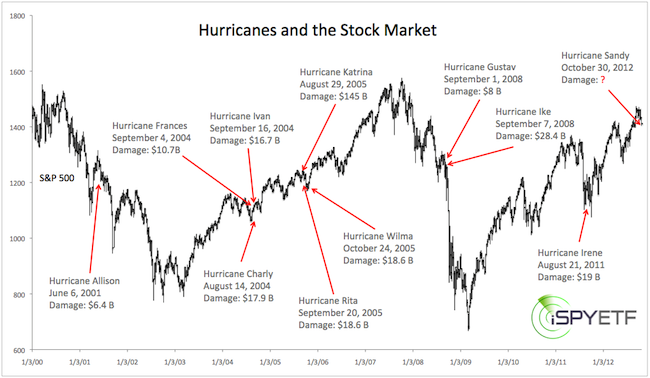

What?s the effect of hurricanes on stocks? The chart below shows all major U.S. hurricanes (since the year 2000) in correlation to the S&P 500 Index.

Allison in June 2000 came amidst the tech bubble deflation. Charly, Frances, Ivan, Katrina, Rita, and Wilma didn?t make a dent in the 2002 ? 2007 market rally.

Gustav and Ike happened right before the financial sector unraveled in 2008 and Irene landed on shore at a time when we expected a major market bottom.

The August ? October timeframe happens to be a tumultuous one for nature and stocks and recent hurricanes coincided with stock market inflection points.

This could be the case again with Sandy. Last week?s Profit Radar Report pointed out that the S&P 500, Dow Jones Industrials, MidCap 400 Index, and Russell 2000 are all above key technical support.

Like a stretched rubber band they should snap back, but if the don?t they?ll break. As such, the next opportunity will likely be triggered by technical developments not hurricane Sandy. The?Profit Radar Report?will provide continuous updates and trigger levels for the ?stretched rubber band? condition.

Like this:

Be the first to like this.

Source: http://ispyetf.wordpress.com/2012/10/30/how-will-hurricane-sandy-affect-stocks-and-the-u-s-economy/

trina rob dyrdek oberon donald driver donald driver robin thicke mariana trench

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.